Health savings accounts (HSAs) offer incredible tax benefits for individuals enrolled in high-deductible health plans (HDHPs). Given the recent announcement of the 2026 HSA contribution limits, now is an ideal time to reassess your health plan options. As a result, understanding how these updated limits could influence your choices for the coming year is more important than ever.

What’s New in 2026 for HSAs?

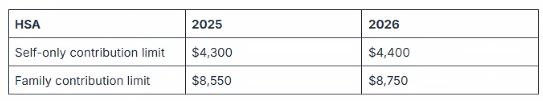

For 2026, the IRS has increased the contribution limits for HSAs:

- Self-only coverage: $4,400 (up from $4,300 in 2025)

- Family coverage: $8,750 (up from $8,550 in 2025)

These increases are in line with inflation adjustments. They also provide more room for individuals and families to save for healthcare expenses.

HSAs provide three key tax advantages:

- Tax-deductible contributions: You can deduct the amount you contribute to your HSA from your taxable income.

- Tax-free growth: Your HSA balance grows without being taxed.

- Tax-free withdrawals: When you use the funds for qualified medical expenses, you don’t pay taxes on the withdrawals.

Understanding High-Deductible Health Plans (HDHPs)

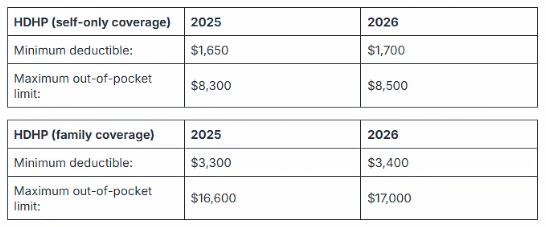

To qualify for an HSA, you must be enrolled in a high-deductible health plan. The IRS defines a high-deductible plan as one that meets these requirements:

- Self-only coverage: A deductible of at least $1,700

- Family coverage: A deductible of at least $3,400

- Out-of-pocket expenses: For 2026, the out-of-pocket limit for self-only coverage is capped at $8,500, and for family coverage, it’s capped at $17,000.

Source: New HSA contribution limit

Medical Costs in Retirement: Planning for the Future

One of the most important reasons to start saving for healthcare expenses now is the rising cost of medical care in retirement. Healthcare expenses in retirement can be substantial, and without planning, these costs can significantly strain your finances.

According to Fidelity, a 65-year-old retiring in 2024 can expect to spend an average of $165,000 on healthcare throughout retirement. Additionally, this estimate does not account for long-term care expenses, which can significantly increase overall healthcare costs.

A health savings account (HSA) can help offset these future expenses. By contributing to an HSA now and investing for the long term, you can build a cushion to help cover the increasing costs of medical care as you age. Furthermore, the funds in your HSA are portable, meaning you can take them with you when you change jobs or retire, giving you flexibility as you transition into retirement.

Selecting the Right Health Plan for 2026

When choosing a health plan, it’s important to consider both your current healthcare needs and your long-term financial goals. Here are some key factors to help guide your decision:

- Healthcare Needs: If you or a family member has frequent medical expenses or chronic conditions, you may want to consider a plan with lower deductibles, even if it means higher monthly premiums.

- Saving for the Future: If you’re in good health and can afford higher out-of-pocket costs, a high-deductible health plan (HDHP) paired with an HSA can be a great way to save for future medical expenses, especially in retirement. HSAs are portable—you can take the funds with you when you change jobs or retire, offering added flexibility.

- Tax Advantages: HSAs offer unmatched tax advantages. If you’re focused on maximizing your tax-free growth, an HSA is a smart choice. However, you must ensure that your selected health plan qualifies for HSA contributions. It must be an HDHP plan (high deductible health plan).

- Employer Contributions: Some employers offer contributions to your HSA. If your employer offers this benefit, it can help you reach the contribution limit more quickly.

- Cost Considerations: Evaluate both the premium costs and out-of-pocket maximums of the HDHPs available to you. In 2026, the contribution limit increases, but the out-of-pocket maximums for HDHPs are also rising. Ensure the plan fits within your budget for premiums, deductibles, and potential out-of-pocket costs.

Conclusion

The increased contribution limits for HSAs in 2026 provide more opportunities for saving on healthcare costs, and selecting the right health plan is crucial to making the most of this benefit. Moreover, by evaluating your healthcare needs, tax advantages, and long-term savings potential, you can choose a plan that will help you build a healthier and financially secure future. The “Big Beautiful Bill” will also allow use of better access to telehealth, will allow seniors who are still working and enrolled in a group insurance to continue to contribute to the HSA, and will allow even gym memberships to be paid out of the HSA accounts.

Contact us at Solid Health Insurance Agency with questions if the HDHP plan be right for your medical needs or run your quote.

Disclaimer: This story is auto-aggregated by a computer program and has not been created or edited by healthlydays.

Publisher: Source link